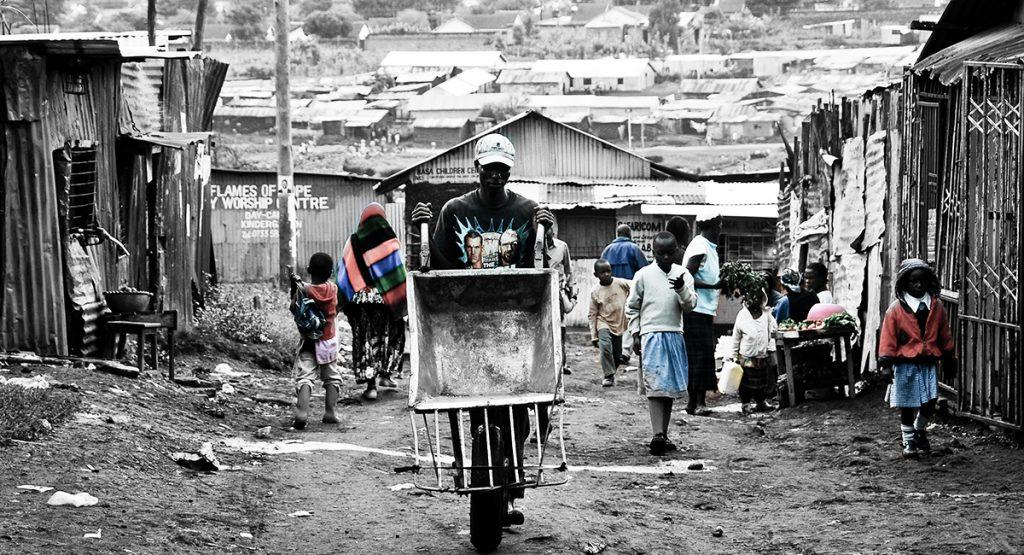

Africa is often characterized by poverty. With the aim of development, these third-world countries tend to apply for foreign aid which heaps up and accumulates into billions in debt. The accumulation of bulks of loans is alarming and raising concerns. The concern is not just about the amount of debt relative to national income, but where the debt comes from. Giving an example of Kenya, the National Treasury report as of March 2018, showed that more than half (USD$24.5billion) public debt came from outside the country. Though studies show that external debt is not necessarily harmful as it can stabilize an economy and economic growth, it, however, depletes a country’s foreign exchange reserves. The depletion of a country’s foreign exchange is achieved because interest and principal repayments on external debt are made in foreign currency and this may devalue the domestic currency. In the short run, the country’s exports may lack the competitive touch hence a weak currency. When the currency is weak, it may lead to high inflation rates in the long term because it costs the country more to import what it needs for production and consumption.

How external debts pose great threats

External debts, especially foreign aids are believed to put debtors in situations that pose greater danger. Similar to Eurobonds, bilateral agreements are believed to cost a lot more than their explicit interest charge. Taking the case of China, where it is Kenya’s largest creditor, holding about 72% of the country’s bilateral debt; studies show that Kenya’s Chinese debt poses a threat because the loan agreements are not transparent, projects are not prioritized, accounting procedures are weak and it’s not clear what projects are costing. On top of this, most Chinese loans are conditional on Kenya’s acceptance of Chinese contractors. This limits the loans’ developmental impacts through potential technology transfers which could improve the country’s productive capabilities and in turn its future ability to comfortably absorb the debt burden. This kind of threat is not wholly likely to affect Kenya only. Many countries in Africa are on the verge of getting the same treatment or maybe they are facing the threat already. Giving a look at these countries’ Chinese debt is worrying. Angola is the most indebted African country to china with an estimated debt of over US$25billion. The threat that Angola is facing is that, despite it being the second-largest producer of oil in Africa, most of its oil is going towards the repayment of Chinese debt. East African countries have an estimate of over US$30 dollars debt to China which was overseen in the building of infrastructure especially roads and railway lines whose contractors are Chinese, but because of a lack of transparency and accountability, a lot of money has been lost to corruption hence threatening the East African coast from captivity by the Chinese. The Democratic Republic of Congo (DRC) could be one of the richest countries in the world considering how it is abundantly endowed with precious natural resources and minerals. However, the plundering of these resources and the unending debt to China of US$3.4 billion has set the country back.

African countries need to be cautious and prudent with the resources available within and produce for both consumptions and for exportation. Borrowed funds should be put to productive use. Investing them in improving public infrastructure would lower the cost of doing business and make a country an attractive investment destination. This in turn would bolster economic output, and therefore its ability to service the debt and, in the long run, lessen the need for additional debt.

Isaac Murimi

Contact Number: 0796962375

Social media handle @m.blizzler