Illicit Financial Flows are a significant threat to Africa’s Sustainable Development Goals. The International Tax Justice Academy (ITJA) is a capacity-building program launched in 2014 under the umbrella of the Tax Justice Network Africa (TJNA). The academy was started as a pan – African initiative to bridge an existing knowledge gap on tax justice in Africa. And since then they have been on course to achieve the goal.

International Tax Justice Academy’s main objective is to encourage the participation of tax justice campaigners at national, regional, and global levels. The capacity building program is to intensify the capability of Civil Society Organizations (CSO), academia, trade unions, researchers, journalists to enlighten and engage citizens on tax justice issues.

ITJA training strengthens evidence-based advocacy, awareness, and distribution of relevant information to increase knowledge-base, influence policy reform, and monitor progress. The methodology of training ensures learners grasp the knowledge and meet TJNA’s aim of increasing participation of CSOs and journalists.

Since the United Nations member state adopted Sustainable Development Goals (SDG) in 2015 as a global call to action for zero poverty, hunger, and protecting the planet by ensuring peace and prosperity. African countries have a long way to go, and the 17 SDGs are all integrated; one effect on an area will affect the outcome of the rest and SDGs can only be achieved by initiating a balance between social, economic and environmental sustainability.

ITJA offers skills for sustained advocacy, dialogue and discussion through courses on Illicit Financial Flows (IFFs), tax governance and Domestic Resource Mobilization (DRM) in Africa, supported by research and participation of key players. Illicit Financial Flows are a significant threat to Africa’s Sustainable Development Goals. It has slowed and destroyed the progress of African countries’ economies and contributed to the increase of insecurity and inadequacy to raise tax revenues.

On the contrary, most developing African countries are not maximizing the use of domestic resources not because they lack them, but due to the significant levels of Illicit Financial Flows that have reduced the ability to raise the required tax revenues.

Hence, the Sustainable Development Goals in African developing countries are at risk. IFFs have posed multiple threats to SDGs’ agenda by consuming the much-needed tax base for public investment and social spending.

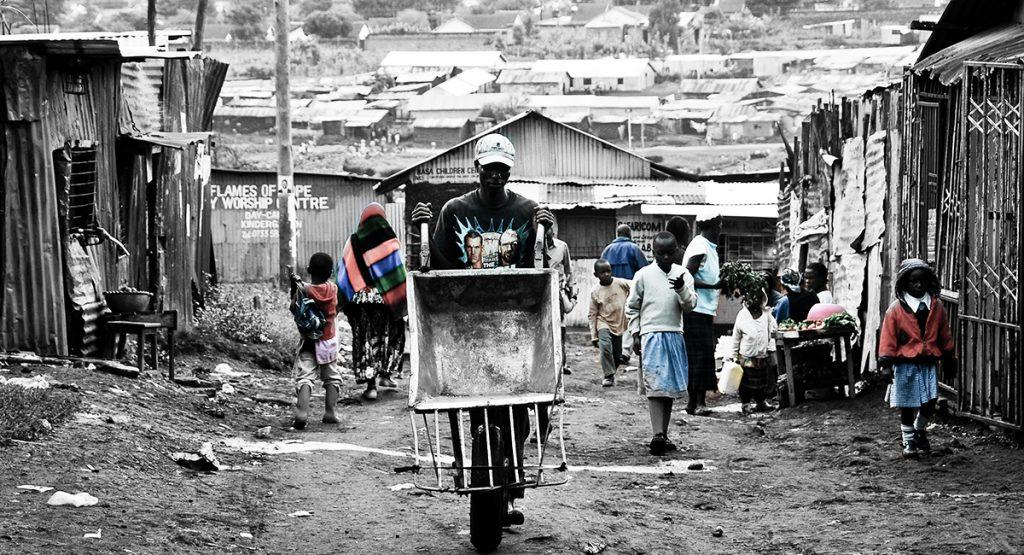

Instead of working towards achieving SDGs in Africa; reduce the continent’s $31 billion infrastructure financing gap, youth unemployment and tackle climate change, governments are continually using domestic savings that could help replenish our infrastructure systems. All we see is African countries struggling in poverty, governments fighting against each other, and an increase in inequality and rent-seeking rather than maximizing the use of domestic resources for productivity.

Illicit Financial Flows is destroying our African nations as this practice threatens not only banks and financial intelligence units but also legal mechanisms for detecting and prosecuting perpetrators of illicit financial flows. These trends leave us desperate for external aid, putting our continent in the light for exploitation, and yet we have the resources to build Africa and even supply to the rest of the continents.

IFFs have continually made us helpless and economically dependent on other continents for aid. Such a scenario is reflected by the proportion of official development assistance in the budgets of African Governments. In some countries, official development assistance accounts for 70 percent of total government revenue. If it were not for Illicit Financial Flows, our African countries would not be so dependent on foreign aid. And yet we could use our domestic resources, grow our economies, and still employ millions of African youths.

It is time for our African governments to establish working policies and stop the flow of illicit finances, apply their ‘political will’ in achieving SDGs and most importantly, provide access to justice for all and build effective, accountable and inclusive organizations at all levels. While those in the private sector expect fair, clear and transparent tax and trade policies, they must do their part by ensuring their tax and trade practices comply with local laws.

If our governments work closely with the private sector, civil society organizations, trade unionists, and the media, to stop the circulation of incentives to engage in illegal behaviors, we could give the people their rights, security, and opportunities to develop our economies.

Written By Faith Ogega | Email: faithogega95@gmail.com